how to watch for fake checks Red Flags to Watch For. Unexpected Checks: Be cautious if you receive a check out of the blue, especially if you haven't requested it. Pressure to Act Quickly: Scammers often create a sense of urgency. They could threaten a loss of .

Browse Louis Vuitton FAQ and find all informations about Exchange . Skip to main content . LOUIS VUITTON. Menu Close . Flight Mode. Nautical Collection. The GO-14. Spring-Summer 2024 Show. LV Remix. Cruise 2024 Collection. Pre-Fall 2024 Collection. The Latest. Spring Collection 2024. . Louis Vuitton Watch Prize for Independent Creatives .

0 · how to identify fraudulent checks

1 · how to check for fraud

2 · how to check before depositing

3 · fraudulent checks scam

4 · fraudulent checks examples

5 · check verification before depositing

6 · check authenticity checks

7 · characteristics of a fraudulent check

Check out our eye tech mousepad svg selection for the very best in unique or custom, handmade pieces from our mousepads shops.

how to identify fraudulent checks

Fake checks might look like business or personal checks, cashier’s checks, money orders, or a check delivered electronically. Here’s what to know about fake check scams. Types of Fake .

With check fraud running rampant, you may wonder how to tell if a check is fake, what to do if you believe you have received a fake check, and what happens if you . Businesses should learn to spot security features such as watermarks, holograms, security threads, special inks, and the Magnetic Ink Character Recognition (MICR) line to detect a fake check. Checks are a valid payment method. But if you receive one in the mail or are given a check from a suspicious source, you need to be cautious. In this guide, we’ll explain how fake check scams work, what happens when you .

wertheimer chanel

how to check for fraud

4 steps to spot a fake check and avoid trouble. If you receive a surprise check in the mail or an accidental overpayment, or if you qualify for what appears to be a quick and .

Red Flags to Watch For. Unexpected Checks: Be cautious if you receive a check out of the blue, especially if you haven't requested it. Pressure to Act Quickly: Scammers often create a sense of urgency. They could threaten a loss of .Here are three steps that can help you avoid fake check scams. Step 1: Know the common fake check scams. The key to these scams is that you’re asked to act quickly, deposit a fake check, . In a fake check scam, a person you don’t know asks you to deposit a check. It’s usually for more than they owe you, and it’s sometimes for several thousand dollars. They tell . In a fake check scam, a person you don’t know asks you to deposit a check – sometimes for several thousand dollars and usually for more than what you are owed – and .

If you think someone might have given you a fake check, examine the edges of the check to make sure one of them is perforated. If all the edges are smooth, it’s more likely to be fake. A real check should also have a clearly printed bank logo on the front and a check number in the top right corner.

Fake checks might look like business or personal checks, cashier’s checks, money orders, or a check delivered electronically. Here’s what to know about fake check scams. Types of Fake Checks Scams; Why Do These Scams Work? Fake Checks and Your Bank; How To Avoid a Fake Check Scam; What To Do If You Sent Money to a Scammer; Report Fraud With check fraud running rampant, you may wonder how to tell if a check is fake, what to do if you believe you have received a fake check, and what happens if you accidentally deposit a fake check in your bank account. Businesses should learn to spot security features such as watermarks, holograms, security threads, special inks, and the Magnetic Ink Character Recognition (MICR) line to detect a fake check.

Checks are a valid payment method. But if you receive one in the mail or are given a check from a suspicious source, you need to be cautious. In this guide, we’ll explain how fake check scams work, what happens when you deposit . 4 steps to spot a fake check and avoid trouble. If you receive a surprise check in the mail or an accidental overpayment, or if you qualify for what appears to be a quick and easy gig, you.Red Flags to Watch For. Unexpected Checks: Be cautious if you receive a check out of the blue, especially if you haven't requested it. Pressure to Act Quickly: Scammers often create a sense of urgency. They could threaten a loss of prize money, say they’re hiring someone else for the job, or increase the price for services.

burberry art of the trench

Here are three steps that can help you avoid fake check scams. Step 1: Know the common fake check scams. The key to these scams is that you’re asked to act quickly, deposit a fake check, and send back a portion of the funds before your bank can spot the fraud.

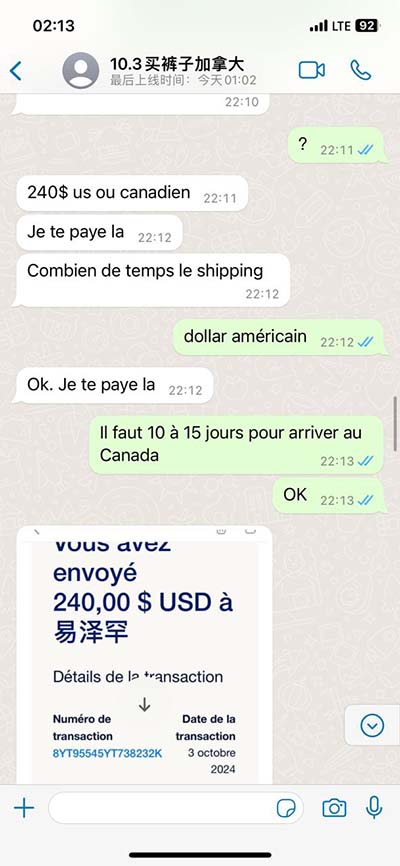

In a fake check scam, a person you don’t know asks you to deposit a check. It’s usually for more than they owe you, and it’s sometimes for several thousand dollars. They tell you to send some of the money back to them or to another person. They always have a good story to explain why you can’t keep all the money.

In a fake check scam, a person you don’t know asks you to deposit a check – sometimes for several thousand dollars and usually for more than what you are owed – and wire some of the money back to that person.

If you think someone might have given you a fake check, examine the edges of the check to make sure one of them is perforated. If all the edges are smooth, it’s more likely to be fake. A real check should also have a clearly printed bank logo on the front and a check number in the top right corner.Fake checks might look like business or personal checks, cashier’s checks, money orders, or a check delivered electronically. Here’s what to know about fake check scams. Types of Fake Checks Scams; Why Do These Scams Work? Fake Checks and Your Bank; How To Avoid a Fake Check Scam; What To Do If You Sent Money to a Scammer; Report Fraud With check fraud running rampant, you may wonder how to tell if a check is fake, what to do if you believe you have received a fake check, and what happens if you accidentally deposit a fake check in your bank account. Businesses should learn to spot security features such as watermarks, holograms, security threads, special inks, and the Magnetic Ink Character Recognition (MICR) line to detect a fake check.

Checks are a valid payment method. But if you receive one in the mail or are given a check from a suspicious source, you need to be cautious. In this guide, we’ll explain how fake check scams work, what happens when you deposit . 4 steps to spot a fake check and avoid trouble. If you receive a surprise check in the mail or an accidental overpayment, or if you qualify for what appears to be a quick and easy gig, you.

Red Flags to Watch For. Unexpected Checks: Be cautious if you receive a check out of the blue, especially if you haven't requested it. Pressure to Act Quickly: Scammers often create a sense of urgency. They could threaten a loss of prize money, say they’re hiring someone else for the job, or increase the price for services.Here are three steps that can help you avoid fake check scams. Step 1: Know the common fake check scams. The key to these scams is that you’re asked to act quickly, deposit a fake check, and send back a portion of the funds before your bank can spot the fraud. In a fake check scam, a person you don’t know asks you to deposit a check. It’s usually for more than they owe you, and it’s sometimes for several thousand dollars. They tell you to send some of the money back to them or to another person. They always have a good story to explain why you can’t keep all the money.

how to check before depositing

3 RINDAS PAR 1 CENU! Pārbaudiet EuroJackpot rezultātus un laimējušos skaitļus tiešsaistē jau tagad pēdējās piektdienas izlozei.

how to watch for fake checks|check verification before depositing